Depreciation charge calculator

Value of the asset 1000. Rate 1 5 100 D.

How To Calculate Depreciation Expense Accounting Basics Cpa Exam Content Writing

Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of.

. You can browse through general categories of items or begin with a keyword search. Rate 20 Depreciable Value per Year is calculated as Depreciable Value per Year Depreciation Rate Purchase Price of. Section 179 deduction dollar limits.

Ad Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. After two years your cars value. Depreciation Amount Asset Value x Annual Percentage Balance.

The Depreciation Calculator computes the value of an item based its age and replacement value. The below types of formula can be used to calculate the depreciation rate Cost of running the car Days you owned the car 365 X 100 Effective life in years lost value Diminishing. Divide the sum of step 2.

Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Depreciation Rate 1 Useful life 100 D.

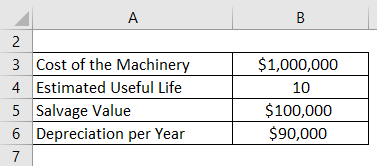

When the value of an asset drops at a set rate over time it is known as straight line depreciation. Cost of machine 10000 Scrap value of machine 1000 Machines estimated useful life 5 years Annual Depreciation Cost of Asset Net Scrap ValueUseful Life. Straight Line Depreciation Calculator.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1 PAN - AAHCT6764E. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae.

Our car depreciation calculator uses the following values source. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. Find the depreciation rate for a business asset.

Depreciation rate finder and calculator. Calculate depreciation for a business asset using either the diminishing value. If the computer has a residual value in 3 years of 200 then depreciation would be calculated on the amount of value the laptop is expected to lose.

Therefore the calculation of Depreciation Amount using Straight-line Method will be as follows Using Straight-line Method Cost of Asset- Salvage Value Useful Life of Asset 15000. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. Calculating Currency Appreciation or Depreciation.

This limit is reduced by the amount by which the cost of. Given 2 exchange rates in terms of a Base Currency and a Quote Currency we can calculate appreciation and depreciation between them. The MACRS Depreciation Calculator uses the following basic formula.

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the. The property depreciation calculator shows your property depreciation schedule year by year the schedule includes Beginning Book Value Depreciation Percent Depreciation Amount. Determine the useful life of the asset.

Ad Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. Method of Calculation. You can use this tool to.

After a year your cars value decreases to 81 of the initial value. Lets take an asset which is worth 10000 and. Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15.

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator

Straight Line Depreciation Formula And Calculator

Depreciation Formula Examples With Excel Template

How To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

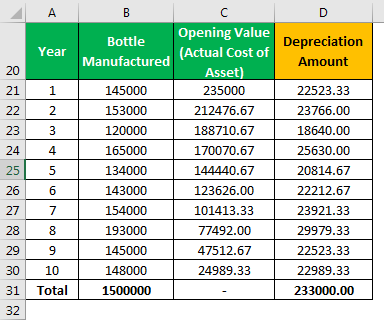

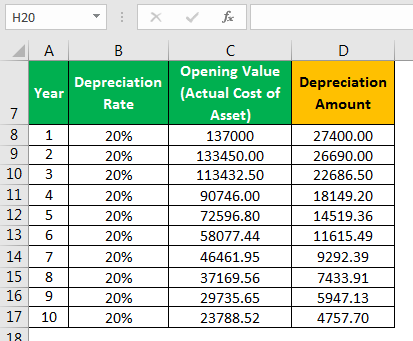

Accumulated Depreciation Formula Calculator With Excel Template

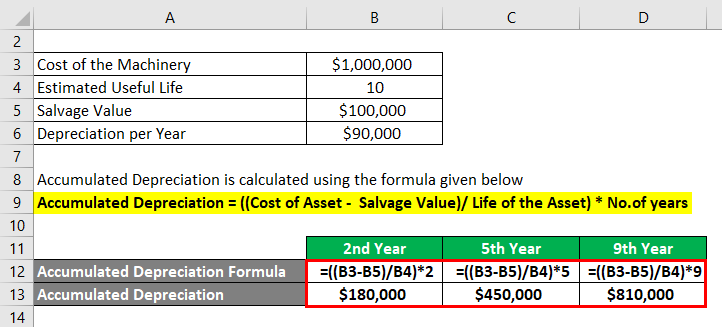

Declining Balance Depreciation Calculator

Depreciation Rate Formula Examples How To Calculate

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Formula Calculator With Excel Template

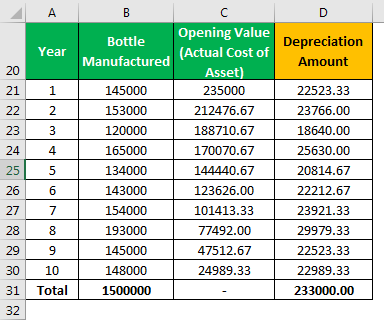

Units Of Activity Depreciation Calculator Double Entry Bookkeeping